So which is it then? Just a few troubled banks plagued by idiosyncratic issues. Or, like when your grandfather finds that odd lump that is probably nothing, is it the start of a systemic catastrophe?

Well, when one canary dies in a coal mine, you can say it was just a dud canary. When a second one dies, it can also be explained away, “that canary has had issues for a while”. A third one, “I’m surprised that canary has lasted as long as it has after the cat attack last summer”. Fourth time around? Perhaps there is an issue with the mine?

Like a formally promising US regional bank, this is the point where I have run out of metaphorical capital. In a mine, you see, after the fourth avian fatality it is rational to flee, as the miners will be safe and the mine will still be intact. The banking system however is like a mine where the miners are also the support beams. The simple act of fleeing will cause the mine to collapse.

This is one of the obscure quirks of “fractional reserve banking”, that they are effectively insolvent by design. When you give a bank £1 of your hard-earned money, like Scrooge on Christmas morn, they will use it to lend £9 out to other people. However, if bank creditors become like Scrooge on Christmas Eve, and ask for their money back at the same time, well then you are dealing with the ghost of money past.

So, should you stay or should you go? And where would you go? What if your only escape was just to another mine? A bigger, better regulated mine, but only if everyone agrees that is the case. Sure, all the canaries for these mines died back in 08, in a catastrophic canary massacre. But since then, these mines have all been reformed and special new regulations have been put in… wait did Tweety just cough?

The VETs (short for very expert talkers) say Tweety is just fine (even though they said that about the canary class of 08), and to prove she’s fine they’ve installed new government backed mine support beams, so even if you did leave the mine, the mine wouldn’t collapse so there’s no need to leave even if Tweety wasn’t fine, even though she is.

Feeling more assured?

The former US secertary of state, George Shultz was being less metaphorical than he realised when he said that “trust is the coin of the realm”. This is the fundamental point about money, there is nothing fundamental about it. The canaries are all of the Schrödingerian variety. Both dead and alive depending on how they are observed. If people trust that Money has value, then it has value. If people lose that trust, then the price of toilet paper should drop dramatically due to the rapid increase in the supply of hand size pieces of paper fit to wipe one’s derriere with. But that metaphor doesn’t quite work either, as paper banknotes are to money as the plastic floppy A disc is to the function of saving a word document. A quaint, increasingly useless, memento of a simpler time.

There was a period when banknotes were trusted because they were made from very special paper that you couldn’t get from Rymans and had a picture of a monarch on it. They also used to be theoretically redeemable for gold, which you couldn’t get anywhere except for a few crumbs in the 17th century Yukon region if you were lucky.

However, whatever paper money is left nowadays, might as well possess the image of outdated 1990s spreadsheet software being misused by a cabal of colluding bankers. That is all money is, a collection of spreadsheets held by bankers who all agree to recognise each other’s spreadsheets as long as they more or less make sense, and nobody important starts to question if the numbers actually add up.

I don’t mean to sound cynical on this point. Spreadsheet money is the product of a sophisticated civilisation, that can only be realised once a society has established a certain degree of trust in its population and institutions. Just like if your spouse asks to borrow a tenner, you don’t take their wedding ring as collateral, credit is more credulous when there is trust. And money creation is essentially the creation of credit on banker’s spreadsheets. This allows economic expansion beyond the actual present level of wealth, and into the future anticipated amount of prosperity before it has actually happened. It is optimism operationalised. It makes self-fulfilling prophecies, self-financing prophecies.

Until it doesn’t. This could be for various reasons, ranging from the malevolent to the insidiously benign. Conmen operate most assuredly in an environment that is based on trust. Even sans conmen, (why does no one say conpersons?), trust-based system tend towards degradation, because everyone is too busy trusting on another and everything seems to be going fine, building more trust, all of which encourages people to take more risk. Eventually the trust between all parties in the system is conflated for a lack of risk in the world, and like Will-E-Cayote still trusting that the ground is beneath him when is already 3m of the edge of a cliff, when trust does finally go, it goes rapidly.

The response to the realisation that the ground is gone is always the same. The injection of trust into the situation. The ceremony always involves someone very important who didn’t see the problem until everyone else already had sagely opining that “we must restore trust in the banking system”.

The issue is that unlike money, trust can’t be created out of thin air, it needs to be earned. Each injection of new trust into the financial system, drains the extant trust capital until all the trust is gone. How long this can continue for is a function of how much trust there is in a society.

In his irreverent treatise on economics “Eat the Rich”, P J O’Rourke mused on “Why do some places prosper and thrive while others just suck?”. There is not really a clear correlation between any one obvious factor. Take natural resources for example. Belgium only really has paedophiles and chocolate, which as the old joke goes, it only makes to lure the children. Japan has few (except for an ability to negate self-gratification and an inherent sense of superiority over the Chinese) yet at one point it was poised to become the largest economy in the world. Switzerland’s ability to keep a secret compensated for its natural lack of gold, motivating many to dig up gold in one part of the world only to entomb it again there.

In contrast, Venezuela is home to the world’s largest oil reserves, yet in recent times the only way to get a decent meal was to break into the local zoo and tuck into a tasty tapir. Africa is replete with minerals and ores galore, yet their key economic achievement in recent years has been to sell those resources to the benefit of the Chinese and aid them in developing an inherent sense of superiority towards the Japanese.

A key factor that separates your Belgiums and Switzerlands from your Venezuelas and Congos is trust. As the below chart from Our World in Data shows on average, and with a few interesting exceptions, the more a nation trusts its own population and its institutions the better off it. Most of Africa has no data, presumably because people didn’t trust the researcher enough to answer their questions.

Interestingly the level of trust in Japan is comparatively quite middling with only 34% of people agreeing with the statement that ‘most people can be trusted’ (compared to 45% in Germany, and a world class 74% in Norway). However, Japan has been in a glacial economic decline since the late 1980s when that figure was 41.5%. Secondly, although the Japanese are relatively distrustful, they are highly obedient and so a lack of trust is not realised in any form of recalcitrant or anti-social behaviour. As the proverb goes, 出る釘は打たれる, “the nail that sticks out is hammered down”. Thirdly, many Japanese suspect their alleged compatriots are secretly Chinese descended.

Interestingly, trust among the population in China is very high at 65%, if only to annoy the Japanese. This underlines the effect of how a communist system can negate the benefits of trustful interactions between individuals. It doesn’t matter if you trust each other if the only legitimate economic interaction is ultimately with a government that doesn’t trust you.

A remnant of communism is not only the erosion of wealth, but also of trust. The former communist countries in Europe all report the lowest levels of trust in society as well as being among the poorest. As a Bulgarian colleague once told me, the only thing you can trust in Bulgaria is that someone will screw you over, so the wise screw first.

In addition to amassing wealth, trust is also essential to surviving economic decline whilst still staying “wealthy”. This is one of the reasons Japan can plod on languorously with its debt being 260% of its GDP, whereas Argentina struggles at 73%. What’s the magic number for the US? It is currently at 125% debt to GDP, can it make it to 150%? Historically, US economic stability has been underwritten by the trust that on balance its legal system and government are accountable and transparent, and that its military might is unchallengeable. All factors which are now in decline.

According to Gallup polling, in 1973% 42% of respondents said that they trusted congress a great deal or quite a lot vs just 7% today. But who trusts pollsters nowadays anyway?

Moreover, the US’s ignominious retreat from Afghanistan was only relatively absolved by the concomitant incompetence of Russia’s botched invasion of Ukraine. Should the Chinese make a move on Taiwan, only a resolutely adept response from the US would prevent a further deterioration of trust in the picture of that pyramid with the eye thing drawn on the back of the greenback.

Of course, the counterpoint to this argument is that during this time of turmoil and increasing bannarisation of the American republic, the dollar has only gotten stronger. But with inflation in the US peaking at 10% officially (and closer to 20% using the previous obviously more correct metrics), in this context “stronger” just means weaker at a slower rate than the other currencies. As mines collapse around the world, it is natural that people will flee to the largest, most robust mine. The one that all roads lead to and accepts all major credit cards for entrance.

But there are these new, fancy, high-tech, cutting edge “Crypto-mines”, which don’t require trust in any VETs or canaries, because they are trustless, so the only trust that is required is for you to trust that they don’t need trust.

The thing is you see, you’re clever, and during lockdown whilst everyone was huddled in their crumbling US dollar mine, you watched a youtube video with a billionaire talking about how bitcoin doesn’t require trust, and none of the suckers in the government or big banks are smart enough to listen to this billionaire with a big baddass boat behind him, and they are all stupid anyway as they caused the last crisis with a thing called leverage, so wouldn’t be as smart as you are to listen to this big baddass boat backgrounded billionaire. Also you’re pretty sure you’re one of the few people to watch this video (despite the 3 million youtube viewer count), as the rest of the slumberous populace are still listening to Lorraine Kelly talk to Martin Lewis about coupons that could save you 30p on your mortgage in 10 years if you switch your ISA to the Natwest British gas account but only on Wednesday.

But eventually these sleepy coupon collectors will realise how clever you were and rush in to buy up what few bitcoins are still left, so you’d be a fool not to use this leverage thing to borrow money to buy more bitcoin right now.

However, like the crypto version of Everything, Everywhere, All at Once, there is a cryptocurrency for every conceivable crypto conception. Sperm-based rocket ship crypto? Cumrocket is up 1,000% this month, and rumour has it Pornhub (which your friends say is the biggest illicit site) will start accepting it as payment. Dennis Rodman smoking weed coin? Potcoin has a fixed supply an there is talk that it will become the official reserve currency of North Korea. But what about Dogecoin? Based on a lovable Shiba Inu pup and it seems pointless, but it is championed by a bigger, more badass billionaire that the one touting Bitcoin, and instead of just models of water ships this billionaire has actual spaceships better than NASAs and he looks more autistic to boot.

So it seems all the more curious that the crypto market cap is down 80%, with cumrocket exploding on lift-off like a botched bukkake bomb test. The issue is that you forgot the aforementioned fundamental point about money. There is nothing fundamental about it. It may well be the case that bitcoin is the most perfect money ever created, but to paraphrase Woody Allen on speedreading War and Peace (it’s about some Russians), most who read the bitcoin white paper and audited its code came to the learned conclusion that it’s about computers. The bitcoin mine is in the end like all the other mines, if everyone flees and stops mining it, the mine will collapse. It may well be a much better built mine than the US dollar based one, but the later has a million times more workers in it, all burdened with tons of coal with limited exit routes. They won’t vacate it so quickly.

But eventually they will have to. Almost all currencies that have ever existed have become extinct. US debt is circa 125% of GDP, and each year it spends 1.4 trillion more dollars than it earns. Just the annual interest payments on the US debt currently accounts for over half a trillion dollars and is poised to double as old debt is rolled over at the new higher interest rates set by the federal reserve (we’ll worry about the 182 trillion dollars of unfunded future liabilities later). As a result, like many uncles, uncle Sam is currently taking out new credit cards just to cover the interest payments on its old credit cards, which increases the debt and accompanying interest, requiring yet more credit cards. What this means is that US has three options:

1. Real sustained economic growth over 6% for decades with no increase in spending.

2. Cut spending dramatically (and give Taiwan to the Chinese).

3. Devalue the currency.

Given that the average annual economic growth in the US over the last decade has been a paltry 2.5%, 6% seems optimistic. Though it is possible if we hasten the AI apocalypse, crack nuclear fusion, and then don’t spend any money dealing with the resultant mass unemployment nor increase defence spending to fight off our new nuclear powered robot overlords. As for cutting spending dramatically, as the kids used to say LOL.

It’s just so much easier to print money, isn’t it?

In this context, and despite what the VETs say, there is nothing unreasonable about hedging against the devaluation of fiat currency by investing in a global, decentralised, voluntary, digital currency that has a fixed supply, and can be held and exchanged directly without the need for central authorities or third parties. One, it is worth mentioning, that has operated flawlessly since 2008, which is over a quarter of the time that the dollar has been on a fiat standard (est. 1971).

Sure crypto is full of conmen but much of the modern financial system was pioneered by unscrupulous characters. The modern bond market has much to owe to the ironically named John Law, a degenerate gambler, who fled England in the late 17th century to escaped imprisonment only to almost bankrupt the French state through his innovative Louisiana company Ponzi scheme. Another ironically named financial entrepreneur, William Blunt, head of England’s largest sword company created an even larger Ponzi scheme called the South Sea company in the early 18th century. This enterprise pioneered many features of stock and share issuance whilst also generating a colossal financial bubble which almost bamboozled as great a mind as Isaac Newton into bankruptcy. A third ironically and convolutedly named financial entrepreneur, Nicholas Unless-Jesus-Christ-Had-Died-For-Thee-Thou-Hadst-Been-Damned Barbon pioneered home insurance and the modern mortgage in the mid 1600s, whilst illegally building houses on the then protected countryside between Westminster and the City of London before deftly becoming an MP to avoid prosecution.

However, in recent years financial innovation has come from more sincerely named conmen. For example, the Roger Hargreaves-esque nominative determinism of the infamous ponziossa Mr Madoff, who pioneered the computerisation of financial markets, founded the NASDAQ, and then “made off” with everyone’s money. Perhaps the issue with the phantasmagoria of crypto-scams is that the names are not ironic or sincere enough. Which is why I’ve done what all good investors do and hedged. 50% in “Sorry-darling-I’ve-mortgaged-the-house-to-buy-this-and-now-we’re-broke-coin”, and 50% in “When-the-US-starts-QE-infinity-and-printing-money-again-we-can-buy-a-better-house-coins”.

Just as the world shifted from gold to paper backed by gold to paper backed by politicians, it can shift to digital money backed by energy intensive computation. Money has been based on much stranger, less operable things in the past. From glass beads used by the Venetians around the world from the 15th to the 17th centuries, to the almost Dr Suess like example of the Pacific island of Yap whose inhabitants used heavy stones hidden underwater that no-one actually saw but all trusted were there. Perhaps the strangest system of all however is the current one, comprising of think slices of a proprietary blend of flax stem and cotton containing pictures of dead people which represents a claim on a number recorded on a spreadsheet controlled by an ex lawyer.

Like a scarlet lady of the night, money can be whatever you want it to be, or more accurately whatever you need it to be. Intrinsic value is an oxymoron, as value is a subjective human construct dependent on context. A man who is drowning would happily swap the water around him for sand, whilst the man dying of thirst in the desert would just as happily take the opposite side of that trade. The Taino peoples of the 15th century Caribbean valued gold so little they gave it away to Christopher Columbus, an act that inspired the future chancellor of exchequer Gordon Brown some half a millennia later.

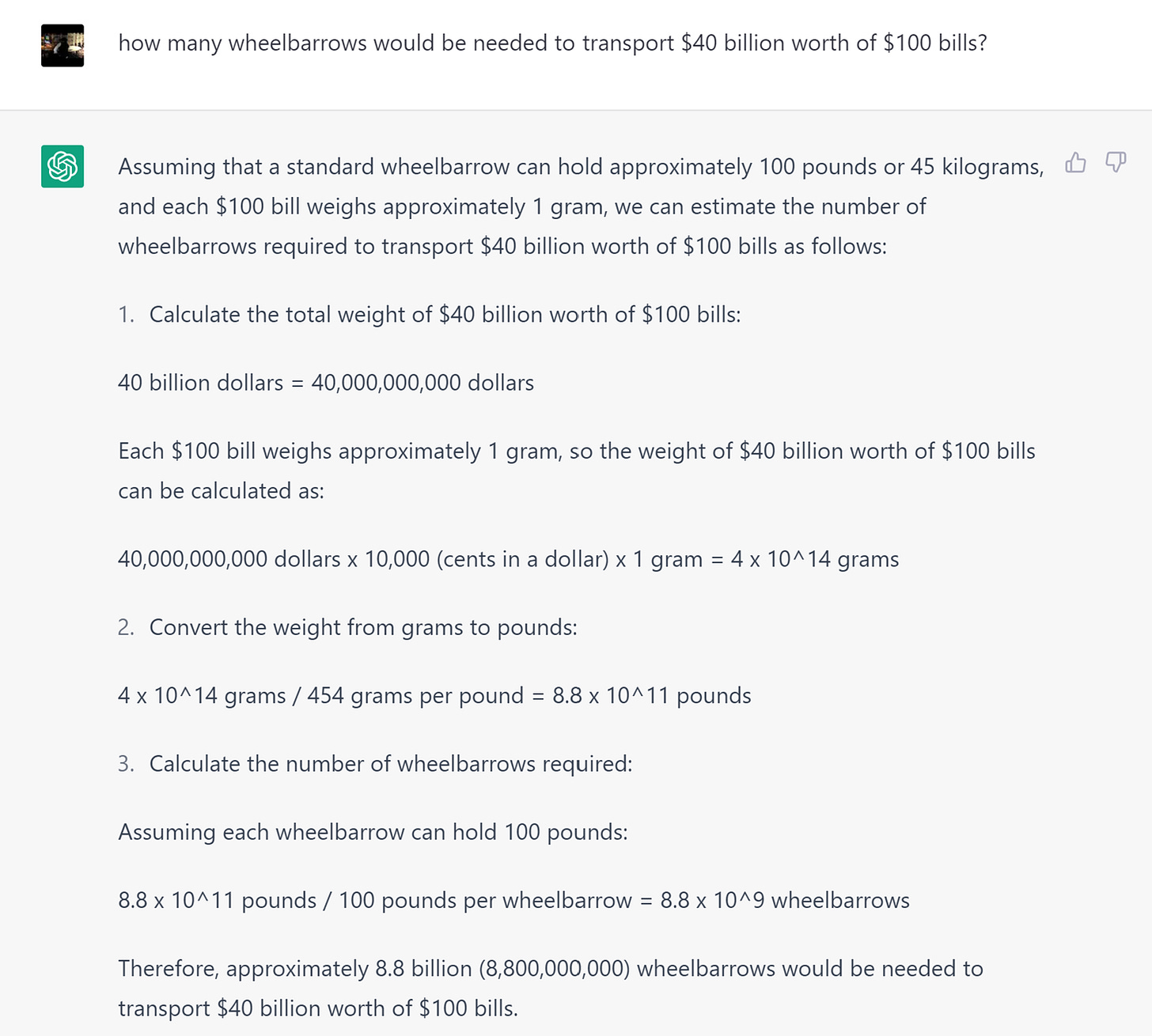

What does all this have to do with a handful of banks failing in 2023? Simply that the utility of money and the accompanying financial system is a function of the society that is using it. As that society changes, so does the monetary system. Silicon Valley Bank’s risk management strategy was perfectly suited for the analogue banking era where people had to wait for their freshly baked morning copy of the Wall Street Journal to arrive steaming on their doorstep to read news of a bank’s troubles. They then had to ferry their wheelbarrow down to the local branch to withdraw as much of their money as they could carry. Ironically it was the very internet-based innovation that the tech-focused Silicon Valley Bank championed that led to its demise. The rapid dissemination of news via social media and the ability to withdraw deposits with the swipe of a touchscreen led to over $40 billion dollars of withdrawals being requested in just one day, which according to Chat GPT would require 8 billion wheelbarrows to carry if denominated in $100 bills. One reason to think that 6% a year AI driven economic growth may not come as quickly as hoped.

I have no idea if the demise of Silicon Valley Bank, Signature, Silvergate, and “Swiss Credit” will extend to other letters in the alphabet, but one should not rest easy on the notion that the financial system can remain robust when it is foundations are from an era that is rapidly changing. I’m not qualified to understand the financial system in its full Escheresque complexity. I’ve tried, but different people contradict each other on the very basics like, does the central bank do anything. Which is kind of my point. We trust that the people running it understand how it works. However, the very people in charge of the current system and who benefit from its continuance will be the least reliable chroniclers of its transition into something new. It is like asking the head of Kodak or Nikon in the early 90s about the future of photography. Anyone have, “most photos will be taken by phones” on their bingo card?

We instinctively imbue money and the financial system with obsidian like foundational qualities because it is what we use to value all other things. We spend most of our energy trying to get more of it, it allows us to swoon our lovers, travel the world, and fix our dishwasher. It is how we quantify our success and failure. It is the denominator infra omnia, below all things. However, as we have explored, that foundation shifts like sand swept by the changing tides of society. The mine may well be fine, but it is a mine built on sand.